Happy New Year! With the new year, of course new year’s resolutions are rampant. On the top of many people’s lists is a better year of budgeting and (less) spending. I am one of those people this year too.

I actually really like budgeting and saving. It may be a control thing. I think it all began at a young age in Monopoly. I would always stow away enough money for Board Walk and Park Place under my chair, in a pocket, under my leg at the beginning of the game. Then, when everyone thought I was broke and I landed on Board Walk/Park Place – BAM! Buy it. Win it. Game over. Anyways, I read something recently that really changed my attitude about money in life. Overall what it said was:

“It’s not how much you make; it is about how well you budget.” That really hit a chord with me.

So when I had some time over Christmas I sat down and got busy on setting myself up for a budget friendly 2012. So the first thing that I did was head to google and search “Microsoft excel budget templates”. I thought, why not see what is out there before I start fooling around with tons of formulas. It brought me here.

I scrolled through them and downloaded everyone that I thought may be helpful for me. Since they are all similar but break things down VERY differently, I actually wanted to play with the different templates before I chose one. So after I downloaded 10 or so, I went to playing with them. While going through them think about a few things:

- How itemized do I want this to be? Do I want to capture every item or just groups?

- How particular do I want my groups to be?

- Do I want it to be monthly, bi-monthly, or weekly?

- How many incomes am I factoring in?

- Is this something that is user-friendly to me?

- Can I easily tweak and change it to fit my budget perfectly?

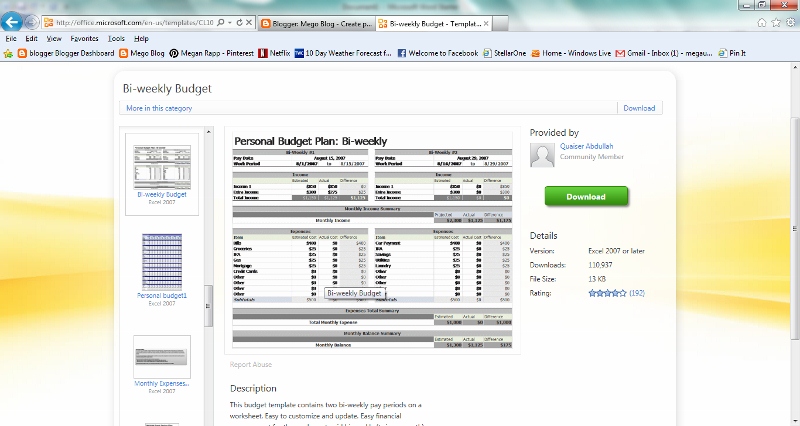

After asking myself all those questions and playing with all the different templates, I finally chose the budget plan below:

Now it was time to make the budget specific to Eric and me. Although I am not going to share our specific budget layout, I will give you some of my tips. I picked the bi-monthly based on my pay period. Into each of the two sections, I then plugged in my reoccurring bills and items that I will probably use every month – like savings, out-to-eat, groceries, etc. With Excel, it provides the luxury of adding lines into the budget every month if you would like. Now with it all personalized it is time to plug in the numbers and keep it updated. That’s the most important thing: stay on top of it, keep it updated, adn STAY ON BUDGET!

What I really like and was my ultimate goal, was to visualize how much and where our money was being spent. Giving a number value to how much I am able to spend every two weeks takes away buyer’s remorse. I know how much I can spend (whether it be for fun or for bills). No guilt if I stay in the budget!

I also did another few things to prepare for 2012 budgeting. I opened up a Savers account at the bank, also known as Christmas Club. Just put a few dollars in it every pay period and they send you a check at the beginning of October. It takes some of the strain out of the holiday season, which I will definitely appreciate next year. Just one less stress out of a busy time. We also have plans to set up another savings account (once we have saved up the minimum) for our travel fund. Just having a few different accounts helps me to NOT spend money. One account that we spend and a few we save for a few different things.

As a final little thing, when in conversation with our financial manager at work, I mentioned my different savings accounts. She reminded me that I could give her the information and dollar amount and she could direct deposit money into into each account. So it takes it directly from what a make and stops giving me the responsibility of putting it into savings – because you know there are always things to buy before you save!

So those are just my few little savings tips to start the news years off. Do you have any budget suggestions to add?